Market Outlook

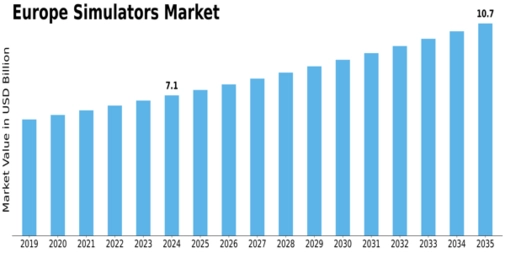

The Europe simulators market is set for steady expansion over the coming decade. According to the MRFR report, the region’s market value rises from approximately USD 7.08 billion in 2024 to about USD 10.7 billion by 2035, representing a compound annual growth rate (CAGR) of around 3.83% from 2025-2035.

This growth reflects heightened demand across sectors for sophisticated simulation solutions, including aviation, defence, training & education, and industrial applications. Innovations in virtual and augmented reality, combined with increasing training requirements, are driving momentum.

Industry Overview

Simulators are no longer niche toys for entertainment; they have become critical tools across multiple industries. In Europe, simulators serve military, commercial aviation, land, maritime, and other platforms. Training institutions, governments, aerospace firms, and manufacturing plants are adopting simulation to reduce risk, save cost, enhance safety, and prepare for complex scenarios. The region’s regulatory pressure, talent shortages and digital transformation imperatives further underpin simulator adoption.

Key Players

The competitive landscape is populated by major diversified technology and aerospace firms. The MRFR study lists players including Thales Group, Siemens AG, Boeing Company, Kongsberg Gruppen ASA, Northrop Grumman Corporation, FlightSafety International, CAE Inc., and others. These companies are leveraging simulation, training and immersive technologies to stay ahead.

Segmentation & Growth Drivers

The market is segmented in multiple ways: by Application (Commercial Training vs Military Training), by Solution (Products vs Services), by Platform (Airborne, Land, Maritime), by Type (Full Flight Simulators, Flight Training Devices, Other), by Technique (Live, Virtual & Constructive, Synthetic Environment, Gaming).

- The Application segment is led by both Military Training (driven by rising defence budgets) and Commercial Training (driven by aviation, automotive, healthcare needs) with strong growth expected.

- Region-wise, Germany takes the lead in Europe, supported by its strong industrial base and technology adoption, followed by UK, France, Italy, Spain and Russia.

- Technique‐wise, immersive and interactive simulation technologies (VR/AR, digital twin, synthetic environments) are gaining traction as organisations seek realistic training in cost‐effective ways.

Conclusion

For firms operating in Europe simulators market Analysis presents an attractive proposition. With a sizeable base in 2024 and clear growth ahead, stakeholders—from developers to training operators—have opportunities to capitalise on increasing demand for simulation solutions. Investment in technological innovation, partnerships, and targeted solutions will likely define winners in this evolving market.