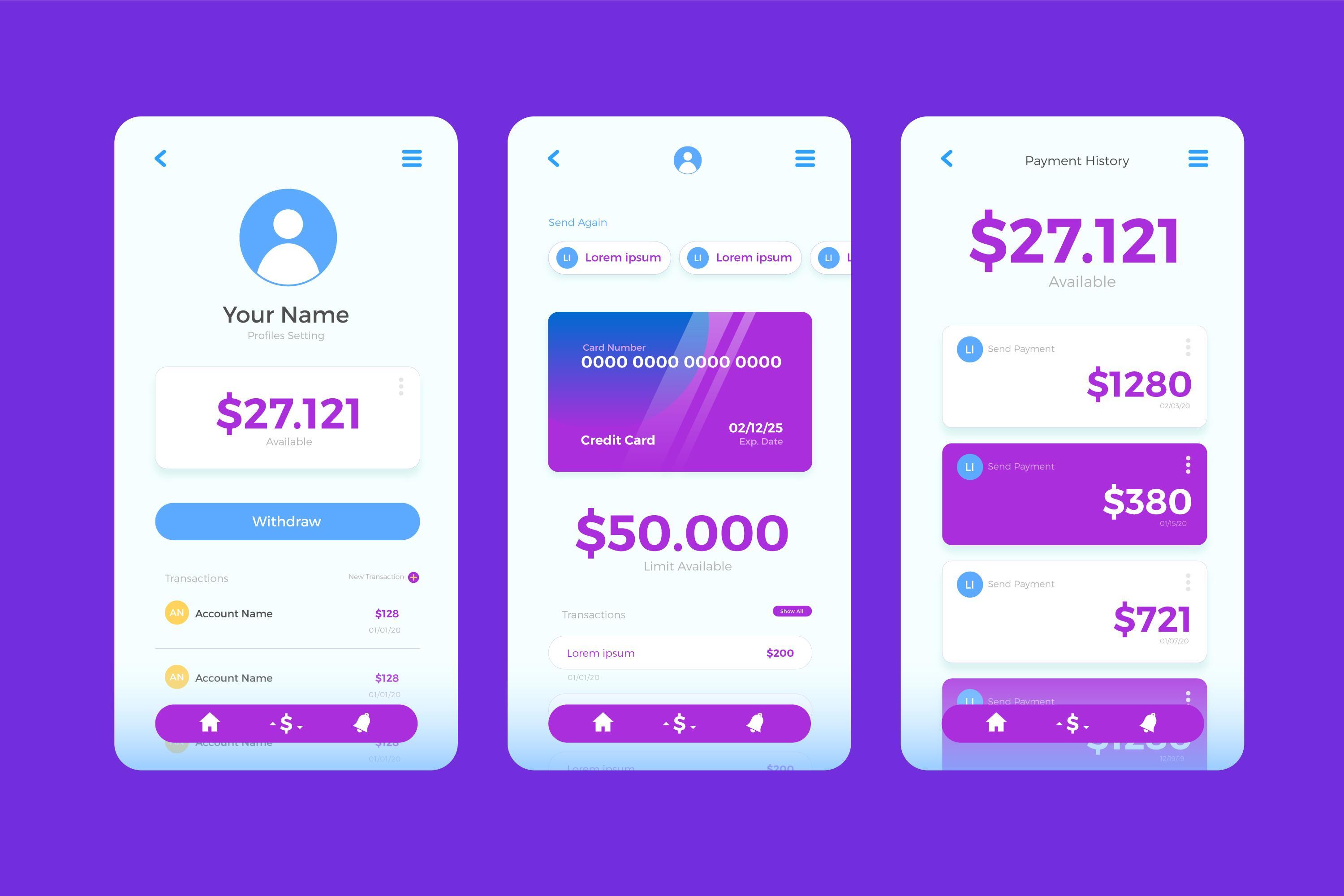

The digital payment industry has transformed rapidly over the last decade. Among the most recognized innovations in this field are peer-to-peer payment applications. One of the most popular models is the Cash App, which offers a fast, secure, and convenient way to transfer money digitally. Many entrepreneurs and startups now seek to create a Cashapp Clone to tap into this growing market. However, when building such a platform, it is essential to implement robust security measures and clearly defined user roles. This blog discusses the crucial aspects of securing a Cash App Clone and designing a role-based user system.

Understanding the growing demand for Cash App Clone platforms

Cash App's popularity has made it a benchmark for aspiring financial technology solutions. People prefer mobile-based transactions due to their speed, accessibility, and simplicity. As a result, creating a Cashapp Clone can help businesses offer a modern and competitive alternative. But such growth also brings increased threats and regulatory responsibilities. A secure architecture is not just an option but a necessity.

Why strong security is essential in a Cash App Clone system

When users transfer money, store funds, or link their bank accounts, trust becomes critical. A single data breach can permanently damage an app’s reputation. Security issues can include identity theft, account hijacking, phishing attacks, and fraudulent transactions. To prevent these problems, app developers must prioritize security from the first phase of the project and continue through deployment and updates.

Key security features required in a Cash App Clone system

Security features act as the foundation of any financial technology platform. Below are essential security measures every Cash App Clone should have:

1. Two-factor authentication (2FA)

To prevent unauthorized access, two-factor authentication adds an extra layer of protection. Users are required to verify their identity using a password and a second factor such as a code sent to their phone or email.

2. End-to-end encryption

All transaction data and communications must be encrypted between users and the server. End-to-end encryption ensures that even if data is intercepted, it cannot be read or tampered with.

3. Device and location monitoring

Detecting unusual device activity or logins from unfamiliar locations helps identify potential security breaches early. Alerting the user and locking the session can prevent fraud.

4. Biometric authentication

Fingerprint or facial recognition helps users log in securely without relying solely on passwords, which can be compromised.

5. Secure APIs

All APIs integrated with banking services, payment gateways, and user data systems must be protected through strong authentication and encrypted communication protocols.

6. Role-based access control (RBAC)

One of the most powerful internal security features, RBAC ensures that users and admin personnel only access the resources relevant to their responsibilities.

Types of user roles in a Cash App Clone platform

User role management is essential for maintaining security, accountability, and operational efficiency. A well-defined role-based access model helps assign specific privileges to users based on their responsibilities. Here are the most common user roles:

1. Standard user

This role belongs to the everyday user of the app. They can send and receive money, link bank accounts, view transaction history, and manage their personal profile.

2. Merchant or business user

Some Cash App Clones offer special accounts for business owners. These accounts can include features like invoice creation, transaction summaries, and integrations with accounting tools.

3. Admin user

Admins manage the overall operation of the system. They have access to user account data, financial transactions, app performance metrics, and system settings.

4. Customer support role

Customer support representatives may need to access specific user account information to resolve queries but should not have full administrative privileges.

5. Compliance officer role

This role is vital for financial institutions to monitor suspicious transactions, perform audits, and ensure the app complies with anti-money laundering (AML) and know your customer (KYC) regulations.

Most effective practices for user data protection and privacy

Protecting user data is at the core of every secure financial application. Data privacy concerns can lead to user mistrust and legal consequences. Implementing these strategies can help:

-

Collect only essential data from users

-

Store data using strong encryption techniques

-

Regularly audit databases for unauthorized access

-

Use anonymization techniques when displaying user statistics

-

Secure data transfers with HTTPS protocols

-

Maintain transparent privacy policies and consent options

How to develop Cashapp Clone with a security-first mindset

Developing a secure Cash App Clone involves more than just copying features. It begins with choosing the right Clone App Development Company that specializes in secure architecture and has a track record in building financial applications. Here are key steps in the development process:

1. Requirement analysis and feature planning

Define your core features such as money transfers, wallet balance, bank linking, and user verification. Decide on the level of security measures needed based on the legal requirements in your target region.

2. Choose a secure technology stack

Select frameworks and languages that support built-in security protocols. Mobile app development often uses platforms like Kotlin for Android or Swift for iOS with secure backend frameworks like Node.js or Django.

3. Integrate banking and payment APIs

Choose secure payment gateways with PCI DSS compliance and bank APIs with strong security protocols. Ensure all API calls are authenticated and encrypted.

4. Implement user verification and compliance modules

KYC and AML procedures must be integrated from the start. Use reliable third-party services to handle identity verification efficiently.

5. Build with modular role-based access control

Segment your application so that each role only accesses what is necessary. This reduces risks from both external threats and internal misuse.

6. Perform penetration testing and vulnerability assessments

Before launch, run security testing to find potential weaknesses. Regular testing ensures the platform stays secure even after updates.

7. Plan for scalability and future compliance needs

As your user base grows, the system should adapt to larger data volumes and stricter compliance regulations. Structure the backend to allow smooth scaling.

Importance of regulatory compliance in p2p money transfer systems

Peer-to-peer payment apps must comply with financial laws to operate legally and safely. KYC ensures that all users are properly identified, which is essential in preventing fraud and money laundering. AML policies are necessary to monitor suspicious activity and report it to relevant authorities. Building a p2p money transfer app development strategy with these compliance frameworks is critical to earning customer trust and satisfying regulators.

Some key regulatory considerations include:

-

GDPR or CCPA compliance for user data privacy

-

PCI DSS compliance for secure payment handling

-

Local licensing requirements for money transfer operations

-

Periodic audit readiness and transaction tracking

Managing fraud prevention and monitoring in real time

Fraudulent activities are a major concern in financial apps. A smart Cash App Clone uses predictive analytics and machine learning to detect suspicious behavior. Real-time fraud detection systems help flag transactions that exceed normal limits or show unusual patterns. Automatic holds and human review systems can help prevent significant losses.

Other fraud prevention tools include:

-

Transaction velocity checks

-

Account IP monitoring

-

Automated blacklisting of suspicious users

-

Geofencing for account restrictions

-

Behavioral pattern recognition

Benefits of a secure and role-managed Cash App Clone system

By implementing strong security practices and well-structured user roles, developers and business owners can enjoy multiple benefits:

-

Build long-term user trust through data protection

-

Reduce the chances of fraud and operational risks

-

Meet all legal and financial compliance standards

-

Ensure transparency and accountability within the team

-

Attract partnerships with financial institutions and investors

-

Scale safely without compromising on performance or safety

Final thoughts

Creating a Cash App Clone requires more than mimicking design and functionality. It involves building a trusted ecosystem where security, privacy, and proper access control come together. With increasing digital threats, a security-first mindset is essential. Choosing an experienced partner like a Clone App Development Company ensures the foundation of your application is built on reliable technology and secure frameworks. A robust Cash App Clone with defined user roles and top-tier security can stand out in the growing fintech space, earning both trust and profitability.